We are an award winning product design consultancy, we design connected products and instruments for pioneering technology companies.

Can the latest medical sensor technologies truly disrupt healthcare?

Reading time 14 mins

Key Points

- Medical sensors are often labelled as disruptive, but few have fully transformed healthcare systems.

- True disruption requires five key elements: affordability, accessibility, convenience, performance, and regulatory legitimacy.

- Most sensor technologies excel at improving user experience but fall short of meeting all five disruption tenets.

- Technologies like biosensing garments, over-the-counter hearing aids, and ingestible sensors show high potential but face regulatory and adoption hurdles.

- Personal Emergency Response Systems (PERS) stand out for serving underserved elderly populations with immediate, life-saving functionality.

- Despite rapid growth, medical sensor adoption is constrained by slow clinical validation cycles and systemic inertia in healthcare.

- Forming strategic partnerships between consumer tech, healthcare providers, researchers, and policy makers is crucial to overcoming barriers and enabling true disruption.

Do you have a healthcare sensor idea that needs help with technical execution? We design affordable, accessible and scalable solutions – without compromising quality and safety.

Ben Mazur

Managing Director

I hope you enjoy reading this post.

If you would like us to develop your next product for you, click here

No single industry, from aerospace to zoology, hasn’t been transformed by the Digital Revolution (Industry 4.0). Some innovations, such as Uber or online search engines, brought new levels of convenience, personalisation, and access. Others, such as Netflix or M-Pesa (mobile money system), fundamentally changed how services are delivered and consumed and disrupted entire industries. Healthcare is undergoing a similar technological transformation, and at the forefront are the latest medical sensor technologies.

With their promise of real-time diagnostics, remote and preventative disease monitoring, and the ability to democratise access to healthcare, medical sensor innovations are often hailed as disruptive. But in an industry regulated and entrenched in legacy systems such as healthcare, can any of these technologies truly disrupt the status quo, or are they simply doing a remarkable job at enhancing and improving the user experience within existing systems?

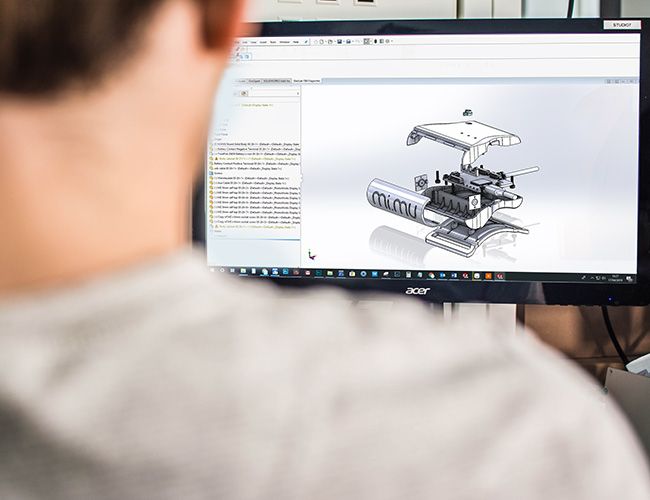

At Ignitec, we help healthtech startups and medtech innovators take bold ideas from concept to commercial success. We’re an end-to-end product development agency, and IoT, wearable devices, environmental monitoring, and health tech are the pillars supporting our work. With in-house expertise in product design, sensor technology integration, wireless connectivity, data security, and usability design, we bring a multi-disciplinary approach that fast-tracks innovation and reduces risk—without compromising quality or compliance. Schedule a free discovery call with an expert on our team for more on what we can do for you.

Why do ‘legacy healthcare systems’ need to be disrupted?

Before answering that, let’s start with what makes an innovation or technology ‘disruptive’. What makes Airbnb but not Tesla disruptive, even though both are game-changers with global success?

The concept of ‘disruptive innovation’ was first introduced in 1997 by Harvard Business School professor Clayton Christensen to describe how new technology can transform a company and revolutionise an industry. His theory outlines the basic tenets and key concepts of disruptive innovation:

- Incumbents (e.g., hotels) focus on improving products and services for their most demanding and profitable customers, exceeding the needs of some market segments and ignoring the needs of others.

- Aspiring disruptors (e.g., Airbnb) enter by successfully targeting overlooked segments (i.e., low-end customers and homeowners) and gaining a foothold by delivering a ‘good enough’ product/service with lower quality at a lower price.

- Incumbents tend not to respond vigorously, as their focus is on the high-end, more profitable market

- Entrants start moving upmarket – delivering the performance that the incumbent’s upmarket/mainstream customers require (e.g. better quality) without neglecting the low-end customers responsible for their early success (e.g. low cost)

- When mainstream customers start adopting the entrant’s offerings in volume, disruption occurs as a completely new market is established

Traditional healthcare systems, known as the medical models, have been centred around hospitals, specialists, and expensive infrastructure. This model:

- Prioritises reactive care over prevention

- It is often costly and inaccessible to underserved populations

- Tends to serve high-margin patients while overlooking lower-income, rural, or preventative segments

- Often affords its patients minimal input into their treatment plan or daily routines (i.e. little to no personalisation)

This sets the stage for disruptive healthcare entrants: those who can address the shortcomings of legacy healthcare systems by offering accessible, affordable, and efficient solutions focused on improving access to care for underserved groups and who can eventually move upmarket to challenge incumbents.

Telemedicine is an excellent example: Initially used in remote areas, it grew significantly, especially during the COVID-19 pandemic, and now offers the possibility of medical consultations anytime, anywhere, reducing costs and increasing accessibility.

What Are Medical Sensors?

Medical sensors measure biological, chemical, or physical signals and are often embedded into wearable, implantable, or ingestible devices. They’re used to collect and monitor health data in real time, such as:

- Vital signs monitoring (e.g. heart rate, blood pressure)

- Biochemical detection (e.g. glucose, lactate, hydration)

- Environmental context (e.g. posture, movement, ambient temperature)

Data collected by these devices is processed to deliver actionable insights that often result in improved outcomes for the user or patient. Modern sensors now work in tandem with AI, edge computing, and remote monitoring platforms, enabling new forms of care delivery.

How are the latest medical sensor technologies innovation-driven?

Medical sensor technology is rapidly evolving. The global medical sensors market, valued at USD 42.6 billion in 2023, is projected to reach approximately USD 144.8 billion by 2030. This growth is attributed to:

- The development of biomedical science and micro-machining technology

- Miniaturisation enabling easier integration

- The development of wireless portable medical devices

- The growing prevalence of chronic diseases worldwide

- The development of sensor-enabled pills and digital medication (e.g. ‘smart pills’)

Advances in sensor design and miniaturisation

Today’s sensors are smaller, more accurate, portable, energy-efficient, and capable of operating non-invasively or semi-invasively. This opens up continuous monitoring outside clinical settings, improving patient comfort, convenience, and adherence.

Example of potential disruption:

A disposable, low-cost continuous blood pressure patch for rural populations without access to clinics could target overlooked segments. It could evolve into a disruptive solution if quality and cost are balanced well enough to serve those outside the traditional system.

New materials and manufacturing techniques for medical sensors

New materials and manufacturing techniques are being used to develop medical sensors that are more sensitive, selective, and stable. Flexible electronics, biodegradable substrates, and 3D-printed microfluidics allow mass production at lower cost, making sensors more scalable.

Example of potential disruption:

Low-cost urine test strips with integrated Bluetooth (e.g. smartphone-assisted urine analyser) could provide early detection of kidney disease in underserved populations. If adopted widely by pharmacies or community health workers, this could become a low-end disruptor that bypasses hospital labs.

Enhanced data analytics and interpretation

Integrating AI and machine learning into sensor ecosystems is critical for making sense of the vast amounts of raw data generated by medical sensors and turning it into actionable insights. This helps to enable remote triage, predictive analytics, and autonomous diagnostics.

Example of potential disruption:

An AI-powered oximeter designed to diagnose COPD (chronic obstructive pulmonary disease), learn patient baselines, and auto-escalate critical cases could reduce unnecessary hospital visits. If deployed in bulk by a public health body or low-cost insurer, it could sidestep traditional GP triage entirely.

Have any medical sensor technologies disrupted healthcare?

The five tenets of disruption require innovation that targets overlooked users, delivers a more straightforward or cheaper solution, improves quality and service offerings over time, and eventually displaces the incumbents and changes the status quo. This process is uniquely complex in healthcare due to strict regulations, entrenched delivery models, and long adoption cycles. However, some sensor-based technologies are showing signs of disruptive potential—especially those designed to address the needs of marginalised, ageing, or chronically ill populations.

While none have ticked all five tenets of disruption just yet, the following examples may still reach that tipping point soon.

1. Personal Emergency Response Systems (PERS)

- Underserved market: Elderly individuals living independently, especially those in rural areas or with limited family support.

- Disruptive potential: High. PERS offer a low-cost, non-invasive way for older adults to get immediate help after a fall or health incident—without relying on institutional care.

- What’s preventing 5/5: Traditional PERS are often reactive (only useful after an event), and many require manual activation. They also remain tied to older service models (e.g. call centres) rather than autonomous care networks or predictive systems. Innovation in AI-powered fall detection and predictive analytics is starting to close this gap.

2. Over-the-Counter Hearing Aids (with embedded sensors)

- Underserved market: Individuals with mild-to-moderate hearing loss who can’t afford or access audiologist-prescribed hearing aids.

- Disruptive potential: Medium–High. The shift from prescription to OTC makes hearing support more affordable and accessible, breaking the traditional clinical pathway. Sensor-embedded aids can also track biometrics like balance or detect early signs of cognitive decline.

- What’s preventing 5/5: Despite regulatory approval (e.g. in the U.S.), uptake has been slow due to a lack of public awareness, limited integration with broader health systems, and stigma around hearing aids.

3. Biosensing Garments (Smart Clothing)

- Underserved market: Patients with chronic illnesses (e.g. cardiac or neurological conditions), athletes, and elderly populations requiring continuous monitoring.

- Disruptive potential: Medium. These garments collect real-time data like heart rate, respiration, and posture without intrusive devices, offering a potential alternative to clinic-based diagnostics.

- What’s preventing 5/5: Costs remain high, durability and comfort need improvement, and healthcare systems are still unsure how to integrate or reimburse such technologies. Most still complement rather than replace traditional monitoring methods.

4. Ingestible Sensors

- Underserved market: Patients with adherence issues (e.g. those with psychiatric conditions, elderly patients taking multiple medications), and those requiring GI monitoring.

- Disruptive potential: Medium. Ingestible sensors can track medication compliance or monitor internal physiology, helping to shift care from clinics to home settings.

- What’s Preventing 5/5: High regulatory and privacy hurdles, cost concerns, and a general reluctance by patients and providers to adopt internal tracking technology. Most implementations still rely on traditional prescription and data infrastructure.

5. Saliva-Based LFIA (Lateral Flow Immunoassay) Tests

- Underserved market: Populations in low-resource or rural settings, needle-averse individuals, and use cases needing rapid, at-home diagnostics.

- Disruptive potential: High. These non-invasive tests are cheaper, easier to administer, and scalable for mass testing (e.g. during pandemics or early cancer detection).

- What’s preventing 5/5: Clinical accuracy, regulatory approvals, and trust in results still lag behind lab-based tests. Integration into care pathways and EHR systems is also limited, slowing mainstream adoption.

Final thoughts: Innovation does not equal disruption

The latest medical sensor technologies are impressive and impactful. But they are not inherently disruptive – nor do they need to be if they intend to deliver a unique solution to an end-user’s pain point.

True disruption demands a shift in who is served, how care is delivered, and who holds the power in the system. Sensor technologies could still be the seeds of future disruption — especially if they’re:

- Designed with low-end use cases in mind,

- Deployed in non-clinical channels, and

- Evolve to meet mainstream performance standards over time.

Developing healthcare technologies is understandably challenging, and the pace of change is slow (regulation, compliance, clinical trials, and testing take time). Forming strategic partnerships and fostering collaboration between consumer tech companies, healthcare providers, researchers, and policy makers is crucial to overcoming challenges and creating an environment conducive to disruption.

Whether you aim to improve hospital diagnostics or design a disruptive sensor for underserved communities, we can help you bridge the gap between technical ambition and market execution. We work with startups, research teams, and enterprises to rapidly prototype functional devices, confidently navigate medical regulations, and build scalable, production-ready solutions. Ready to take your medical sensor idea from concept to clinic? Book a free and confidential consultation with an expert on our team.

Medical device prototyping: Accelerate innovation & turn complex ideas into life-changing products

The Digital Health Revolution: How technology is transforming healthcare delivery

How medical IoT offers enhanced versions of conventional devices

FAQ’s

What are the latest medical sensor technologies used in healthcare?

The latest medical sensor technologies include biosensing garments, ingestible sensors, saliva-based lateral flow tests, over-the-counter hearing aids, and Personal Emergency Response Systems (PERS). These tools aim to improve accessibility, continuous monitoring, and patient autonomy. However, few have yet disrupted traditional healthcare models entirely.

How are medical sensors changing elderly care?

Medical sensors such as PERS and fall detection devices provide round-the-clock monitoring for the elderly living alone. They help reduce emergency response times and support independence. While promising, many still lack integration with broader care systems to be wholly transformative.

Why haven't medical sensor technologies entirely disrupted healthcare yet?

Most medical sensor technologies fall short on at least one of the five tenets of disruption, such as regulatory approval or cost-effectiveness. Clinical trials, cautious regulatory bodies, and lengthy data validation periods delay broad adoption. Until these barriers are addressed, their impact remains supportive rather than transformative.

Which medical sensors are close to being truly disruptive?

Biosensing garments and over-the-counter hearing aids are among those with strong disruptive potential. They target underserved markets and improve accessibility, but still face challenges in affordability and scale. Ingestible sensors also offer innovation, but are limited by regulation and cost.

What is the role of ingestible sensors in modern medicine?

Ingestible sensors can monitor internal health metrics like medication adherence and gut temperature. They offer real-time data from within the body, something traditional wearables can’t provide. However, they remain expensive and are not widely available or trusted in mainstream healthcare.

How do biosensing garments work?

Biosensing garments are smart textiles embedded with sensors that track biometrics like heart rate, respiration, and movement. They offer a non-invasive, comfortable alternative to bulky medical devices. Their potential to disrupt lies in passive, continuous health monitoring—if they become affordable and clinically validated.

Who benefits most from over-the-counter hearing aids?

People with mild to moderate hearing loss, particularly in lower-income or rural communities, benefit most from OTC hearing aids. These devices eliminate the need for a specialist, lowering the barrier to access. However, limited awareness and inconsistent quality still slow widespread uptake.

When will saliva-based lateral flow tests become mainstream?

Saliva-based LFIA tests are gaining attention for their ease of use and non-invasive nature. They’re handy for rapid infectious disease testing without clinical oversight. Mainstream adoption depends on further clinical validation and cost reduction.

Why is disruption in healthcare so difficult?

Healthcare is a highly regulated, risk-averse sector with long adoption cycles. Technologies must pass stringent trials and demonstrate safety and efficacy over time. Even promising innovations face resistance unless they align with policy, budget, and provider workflows.

What are Personal Emergency Response Systems (PERS)?

PERS are wearable or home-based sensors that alert carers or emergency services during falls or medical events. They are particularly valuable for elderly individuals living independently. While not new, their simplicity and effectiveness make them a quiet but powerful innovation.

How can sensor technologies reach underserved populations?

Sensor technologies must be affordable, easy to use, and available without clinical infrastructure to reach underserved populations. OTC distribution, long battery life, and minimal setup are key. Subsidies and public health initiatives also play a role in expanding access.

Which types of data do medical sensors typically collect?

Medical sensors collect data such as heart rate, blood pressure, respiratory rate, glucose levels, and body temperature. Some also monitor motion, stress levels, or hydration. The breadth of the data collected depends on the device’s design and intended medical application.

How does regulation affect sensor technology adoption?

Regulation ensures patient safety but often slows innovation by requiring extensive testing and compliance. Startups may struggle to fund these processes, delaying time-to-market. Balancing innovation with safety remains a central tension in healthcare disruption.

Why are clinical trials necessary for medical sensors?

Clinical trials validate the accuracy, safety, and effectiveness of sensor-based technologies. Without them, devices can’t receive regulatory approval or trust from medical professionals. However, trials are time-consuming and expensive, slowing the path to disruption.

What's the difference between supportive and disruptive technologies in healthcare?

Supportive technologies improve existing systems, while disruptive ones reconfigure the system entirely by serving unmet needs in new ways. Disruptive technologies often start small, targeting underserved markets before scaling. Most sensors today are still supportive rather than system-changing.

How can consumer tech companies influence medical sensor innovation?

Consumer tech firms can bring design, scale, and user experience expertise to healthcare. By partnering with medical institutions and navigating regulations collaboratively, they can help accelerate innovation. Their involvement is crucial in bridging the gap between usability and clinical credibility.

What makes a medical sensor affordable in low-resource settings?

Affordability depends on factors like manufacturing costs, reusability, and the need for supporting infrastructure. Sensors that don’t require smartphones, constant power, or clinical intervention are more likely to succeed in low-resource environments. Local manufacturing and simplified interfaces can also help.

Who regulates medical sensor technologies in the UK?

The Medicines and Healthcare products Regulatory Agency (MHRA) regulates medical sensors in the UK. They assess devices based on safety, efficacy, and manufacturing quality. CE or UKCA marking is required before a product can be legally sold.

When do sensor technologies become scalable?

Sensor technologies become scalable when they prove cost-effectiveness, clinical value, and ease of use across diverse populations. Achieving manufacturing efficiency and securing reimbursement pathways are also critical. Without scale, even innovative tools remain niche.

How can partnerships support disruptive medical sensors?

Strategic partnerships between healthcare providers, policy makers, researchers, and tech companies are key to overcoming systemic barriers. Collaboration ensures alignment between innovation, regulation, and real-world use. These alliances can help fast-track adoption and amplify impact.

Get a quote now

Ready to discuss your challenge and find out how we can help? Our rapid, all-in-one solution is here to help with all of your electronic design, software and mechanical design challenges. Get in touch with us now for a free quotation.

Comments

Get the print version

Download a PDF version of our article for easier offline reading and sharing with coworkers.

0 Comments